How Do You Know Which Tax Form to Use

If your tax situation isnt complicated you might be able to take the easy route and file Form 1040-EZ. You need to meet all the requirements such as being under 65 years old single or married filing jointly claiming no dependents and with taxable income less than.

Form 1040 U S Individual Tax Return Definition Income Tax Return Irs Tax Forms Tax Forms

After completing the File section and e-filing your tax return you will receive two emails from TurboTax.

. Did you know there are now more than 800 different tax forms. We Support All the Common Tax Forms and Most of the Less-Used Forms. If you have questions or would like additional information you may call our Customer Service Center at 1-800-400-7115 or your local CDTFA office.

Forms 1040A and 1040EZ are just simplified shorter versions of Form 1040. Incorrect or Missing Form 1099. Three types of information an employee gives to their employer on Form W4 Employees Withholding Allowance Certificate.

Dont use 1040-EZ if you have to report self-employment income or. Number of withholding allowances claimed. How do you know if you are eligible for a 1040a or 1040ez.

Purpose of Schedule A. Learn about the types of Form 1099 what to do if you notice any errors and how to get a copy if you didnt receive one. Ad TurboTax Has A Variety Of Solutions And Tools To Help You Meet Your Tax Needs.

File With TurboTax And Have a Piece Of Mind That Your Taxes Are Done Right. Sales tax is a pass-through tax that businesses charge customers on purchases. The Lookup Table below may be used to pay estimated use tax for personal items.

You can use the 1040-EZ form if you file as single or married filing jointly and with no dependents. Ad TurboTax Has A Variety Of Solutions And Tools To Help You Meet Your Tax Needs. You can always use Form 1040 regardless of whether you qualify to use Form 1040A or 1040EZ.

If you hold a California consumer use tax account you are required to report purchases subject to use tax directly to us and may not report the tax on your income tax return. Businesses and government agencies use 1099 forms to report various types of income to the Internal Revenue Service IRS. Over 50 Milllion Tax Returns Filed.

Well heres your chance to prove just how well you know your IRS tax forms. Be sure to obtain exemption in states where nexus has been established then focus on the type of exemption being. You complete your tax return by finishing all 3 Steps in the File section.

Ad IRS-Approved E-File Provider. 1099 tax forms are used to report investment income to the IRS. In Step 3 to e-file your tax return you must click on the large Orange button labeled Transmit my returns now.

Form 5498 reports contributions and rollovers to individual. The amount withheld depends on. A few years ago taxpayers were able to exclude 4050 or.

You may owe use tax if you made a purchase from an out-of-state retailer and were not charged California tax on the purchase. Three of them the W-2 1098 and 1099 are IRS forms that may be sent to you with information youll need in order to file your taxes. The tax is due when the item is first used in the state and the tax rate is the same as the sales tax rate where the item is being used.

Whether you sell taxable products or services and dont collect sales tax or you purchase items without paying sales tax you must know the sales and use tax consequences of your activities in each state you do business in. As the name implies use tax applies to items being used in Washington where sales tax has not been paid. Here are nine of the top Internal Revenue Service IRS tax forms you might need to know about.

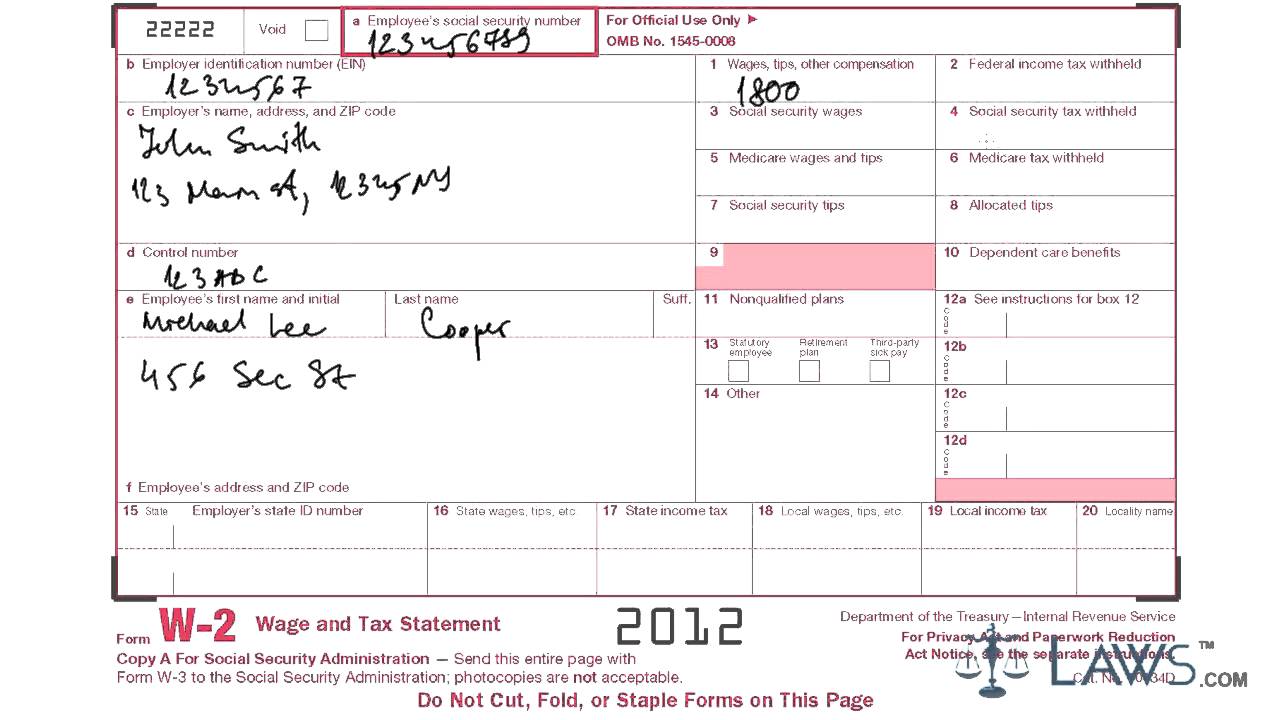

These types of income do not include wages salaries or tips. Employers use this form to report employees annual earnings and taxes withheld for the year. 0 Fed 1499 State.

A tax exemption is the right to exclude certain amounts of income or activities from taxation. How withholding is determined. Use tax on the other hand is not a pass-through tax.

Heres what investors need to know about investment tax forms this year. The amount of income earned and. If you mail a tax return or a payment to the IRS it is a good idea to use a mailing service that will track it like UPS or certified mail so you will know it was received.

Schedule A is required in any year you choose to itemize your deductions. Again you do not need to collect this type of. It applies to both businesses and individuals.

Copies are sent to the IRS the employees and. You can check your answers at the end of this blog post. The schedule has seven categories of expenses.

Total income for you and a spouse must be under 100000 with less than 1500 in interest income. If you have not saved your receipts you may calculate and pay estimated use tax on your 2021 California Income Tax return based upon your income. As a business owner you must know how to calculate sales tax and charge your customers.

Form 1040 Form 1040A and Form 1040EZ. First Some Easy Ones. The first email when your tax return was.

If you have a complex tax situation it may be wise to work with a financial advisor who specializes in tax issues. They are intended for people who have uncomplicated tax returns. Use the worksheet on page 3 of the W-4 to figure out your deductions.

Either the single rate or the lower married rate. Then you must track and remit sales tax to the proper state government. There are three 1040 tax return forms.

File With TurboTax And Have a Piece Of Mind That Your Taxes Are Done Right. When you mail a tax return you need to attach any documents showing tax. Pick the right one and it could make a big difference.

Use tax must be paid by each new owner of the item and. Medical and dental expenses taxes interest gifts to charity casualty and theft losses job expenses and certain miscellaneous expenses. Finally you can also use the extra withholding section to make your total withholding as precise as possible.

The advantages of Form 1040A or 1040EZ is they are easy to fill out and easy to. Beginning in 2018 miscellaneous expenses are no longer.

Learn How To Fill W 2 Tax Form Tax Forms Letter Example Cover Letter Template

Understanding Your Own Tax Return Irs Tax Forms Irs Taxes Tax Forms

Printable Tax Checklists Tax Printables Tax Checklist Small Business Tax

Comments

Post a Comment